Forex trading can be complex and intimidating for beginners, but with the right tools and strategies, it can be a rewarding venture. This article will provide an overview of the basics of forex trading and offer tips for achieving success in the market.

Setting Objectives and Learning the Basics

It is crucial to set achievable trading goals and have a solid understanding of forex trading basics, including terminology, trading platforms, and market analysis. Online trading courses and educational resources provided by trading platforms can help beginners learn the essentials. Additionally, staying informed about economic and political developments can help traders make informed decisions and avoid potential losses.

Practice and Risk Management

Using a demo account and trading simulators allows beginners to practice trading without risking real money, test their strategies, and gain experience. Managing risk is essential in forex trading, and traders should use stop-loss orders, limit orders, and start with a small amount of money to minimize potential losses.

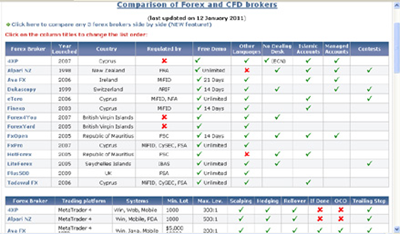

Choosing a Reliable Broker and Trading Strategies

Researching and comparing different brokers is important for successful trading. Retail traders and institutional investors participate in the forex market, which offers benefits such as high liquidity and 24/7 availability. Familiarity with different trading strategies, including scalping, swing trading, day trading, and position trading, can help traders identify opportunities for success.

Social Trading and Financial Forecasting

Social trading is a method of buying and selling assets based on the strategies of other traders, often used by beginners or those with limited time for market analysis. Platforms like FXChoice, MetaTrader 4, and TradingView offer financial forecasting and planning software that can assist traders in managing risk, improving overall performance, and making smarter trading decisions. Accurate forecasting is essential for success in forex trading, and traders must have a solid grasp of market dynamics, technical analysis, and risk management.