High-yield bonds, often referred to as junk bonds, have long been a topic of interest for investors seeking higher returns. These bonds carry a higher risk of default compared to investment-grade bonds but offer the potential for higher yields. In this article, we will delve into the world of high-yield bonds, discussing the risks and rewards associated with investing in them, and providing insights on how to navigate this complex market.

Understanding High-Yield Bonds

High-yield bonds are issued by companies with lower credit ratings, which means they have a higher risk of defaulting on their debt obligations. These companies may have experienced financial difficulties, or they may operate in industries that are more susceptible to economic fluctuations. A recent example of a significant investment in high-yield bonds is Strategic Blueprint LLC’s investment in VanEck Fallen Angel High Yield Bond ETF. This fund focuses on fallen angels or companies that were once considered investment grade but have since seen their credit rating downgraded to speculative or junk status.

The Rewards of Investing in High-Yield Bonds

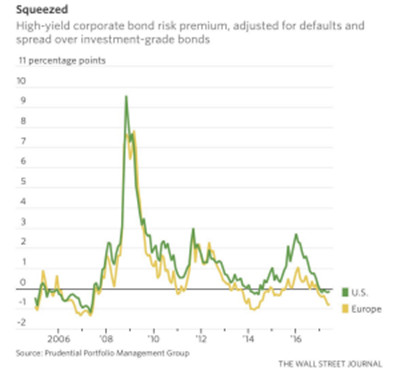

One of the primary reasons investors are attracted to high-yield bonds is the potential for higher returns. These bonds offer higher yields or interest rates compared to investment-grade bonds, which can be particularly appealing in a low-interest-rate environment. High-yield bonds can also provide diversification benefits to an investment portfolio, as they may not be as closely correlated with other asset classes such as stocks or investment-grade bonds.

The Risks of Investing in High-Yield Bonds

While the potential for higher returns is undoubtedly appealing, it’s essential to understand the risks associated with investing in high-yield bonds. The most significant risk is the higher probability of default, as companies issuing these bonds may face financial difficulties or operate in volatile industries. High-yield bonds are also more susceptible to market fluctuations and can experience higher price volatility compared to investment-grade bonds. This means that the value of your investment may fluctuate more significantly over time, which can be a concern for investors with a shorter investment horizon or lower risk tolerance.

How to Approach Investing in High-Yield Bonds

Before diving into the world of high-yield bonds, it’s crucial to assess your risk appetite and investment objectives. If you have a higher risk tolerance and a longer investment horizon, high-yield bonds may be a suitable addition to your portfolio. However, it’s essential to diversify your investments and not rely solely on high-yield bonds for income or growth. Research the issuer of the high-yield bond and consider factors such as the company’s financial health, industry trends, and the overall economic environment. By carefully considering the risks and rewards of investing in high-yield bonds, you can make more informed decisions and potentially enhance your investment portfolio’s performance.