Investing in biotech stocks can be a high-risk, high-reward venture, offering the potential for significant returns but also exposing investors to substantial risks. This article explores the key factors that contribute to the volatile nature of biotech stocks and offers insights into how investors can navigate this complex sector.

Understanding the Biotech Sector

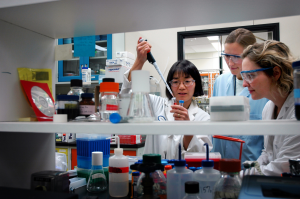

The healthcare industry is one of the largest and most complex in the world, involving pharmaceutical companies, healthcare providers, and regulators. Within this industry, the biotech sector is particularly risky but can offer high rewards for investors who are willing to take on the risk. Biotech stocks are highly volatile and can experience drastic drops in share price if a drug fails FDA trials or if a company experiences setbacks in clinical trials. Thorough research and analysis of a company’s pipeline, management team, and financials are essential before making an investment decision.

Diversification and Risk Management

Diversification is key when investing in the biotech sector to mitigate risk and increase the chances of success. By spreading investments across multiple companies and subsectors within the biotech industry, investors can reduce the impact of any single stock’s poor performance on their overall portfolio. Understanding market volatility is also essential for managing risk during periods of turbulence, as biotech stocks can be particularly susceptible to market fluctuations.

Recent News and Its Impact on Biotech Stocks

Recent news can have a significant impact on biotech stocks, as demonstrated by the ongoing situation involving Illumina and activist investor Carl Icahn. Icahn, who owns a 1.4% stake in Illumina, is pushing for board seats at the DNA sequencing company and calling for Illumina to unwind its $7.1 billion acquisition of cancer test developer Grail. Icahn alleges that Illumina’s directors demanded extra personal liability insurance before signing off on the deal, which he claims was “buried in the hope no one would notice.” Illumina has responded by stating that its risk management and disclosure practices are appropriate and transparent. This situation highlights the importance of staying informed about industry news and understanding how it can impact biotech stocks.

Investing Strategies for Biotech Stocks

There are several penny stock trading strategies that investors can use to manage risk and increase their chances of success in the biotech sector. These include fundamental and technical analysis, trading on news and rumors, and short selling. By employing a combination of these strategies, investors can better navigate the risks and rewards of investing in biotech stocks and potentially achieve significant returns.