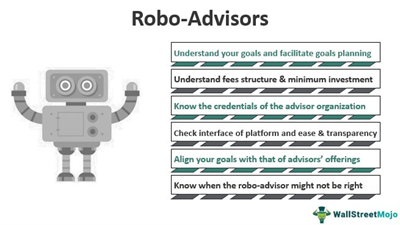

Robo-advisors, AI-powered automated investment advisors that use algorithms to provide financial advice and manage investments, are transforming the wealth management industry. Offering a more affordable and efficient alternative to traditional financial advisors, robo-advisors have become increasingly popular among investors, including beginners.

Top Investment Robo-Advisors: Wealthfront and M1 Finance

Top Investment Robo-Advisors: Wealthfront and M1 Finance

Wealthfront, rated Best Overall Robo-advisor by Investopedia, has been providing automated financial guidance since 2008. Offering a range of tools and a portfolio of ETFs and index funds, Wealthfront helps users manage their finances effectively by aligning with their financial goals and risk tolerance. M1 Finance, on the other hand, combines the functionalities of a robo-advisor and an online broker, catering to both hands-off and hands-on investors. Most suitable for intermediate-level investors, M1 Finance allows for more flexible customization options compared to other robo-advisors.

Features, Costs, and Advantages

Features, Costs, and Advantages

Both Wealthfront and M1 Finance offer minimum initial investment, cash management accounts, a wide range of investment options, and support for various types of accounts. Wealthfront provides daily tax-loss harvesting at no additional cost for all taxable accounts, while M1 Finance offers M1 Borrow and M1 Spend services. Both platforms charge a 0.25% annual advisory fee, which is standard in the robo-advising industry.

AI in Finance: Algorithmic Trading and Innovative Products

AI is redefining the art of making money in the financial world. Algorithmic trading relies on complex algorithms to analyze vast amounts of data and make rapid trading decisions. AI-driven trading algorithms are designed specifically for digital assets like cryptocurrencies. Robo-advisors provide personalized financial advice and investment management services at a fraction of the cost of traditional financial advisors. AI is also being used to develop innovative new financial products and services, such as AI-driven insurance policies.

AI and Finance: New Opportunities for Wealth Generation

AI and Finance: New Opportunities for Wealth Generation

The intersection of AI and finance is opening up new opportunities for wealth generation and changing the way we generate and manage wealth. FinTech companies are leveraging AI, machine learning, and data analytics to automate compliance processes, reduce costs, and improve accuracy. RegTech solutions like KYC (Know Your Customer) and AML (Anti-Money Laundering) are streamlining regulatory compliance, enhancing risk management, and improving customer experience.