Investing in rental properties has become an increasingly popular way to generate income and build wealth. With the rise of platforms like Airbnb, the rental market has expanded to include both traditional long-term rentals and short-term vacation rentals. But which type of rental property is the best investment? In this article, we will explore the pros and cons of investing in both traditional and Airbnb rental properties.

Pros of Airbnb Investment Properties

Airbnb investment properties offer several advantages over traditional rental properties. One of the main benefits is the potential for a higher return on investment (ROI). Since Airbnb properties are rented out on a nightly basis, hosts can often charge a higher rate than they would for a traditional rental. Additionally, Airbnb hosts have the flexibility to adjust their nightly rates based on market demand, allowing them to capitalize on peak travel seasons and special events.

Low Risks and Flexibility for Airbnb Hosts

Another advantage of investing in Airbnb properties is the relatively low risk involved. Unlike traditional rentals, where tenants sign a lease for a fixed term, Airbnb guests typically stay for a few days or weeks at a time. This means that if a guest causes damage or becomes a nuisance, the host can quickly address the issue and move on to the next guest. Furthermore, Airbnb hosts have the flexibility to block off dates for personal use or to accommodate friends and family, making it an attractive option for those who want to maintain some control over their property.

Pros of Traditional Rental Properties

While Airbnb properties offer the potential for higher returns, traditional rental properties have their own set of advantages. One of the main benefits is the stability of long-term tenants. With leases typically ranging from 6-12 months, landlords can enjoy a steady stream of rental income without the need to constantly find new tenants. This can be particularly appealing during uncertain times, such as during a pandemic or economic downturn, when short-term rental demand may be lower.

Set Monthly Rates for Traditional Rentals

Another advantage of traditional rental properties is the predictability of rental income. Unlike Airbnb hosts, who must constantly adjust their rates based on market demand, landlords can set a fixed monthly rate for their rental property. This allows for easier budgeting and financial planning, as well as a more consistent cash flow. Additionally, long-term tenants are often responsible for utilities and maintenance costs, which can help to offset some of the expenses associated with property ownership.

Cons of Airbnb Investment Properties

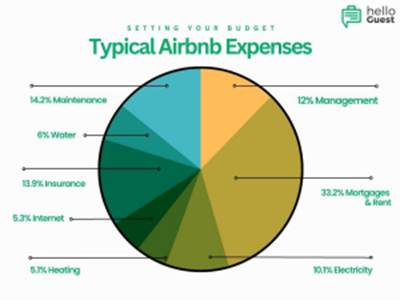

While Airbnb properties offer the potential for high returns, they also come with their own set of challenges. One of the main drawbacks is the higher expenses associated with short-term rentals. Airbnb hosts often need to invest in additional insurance coverage, pay platform fees, and cover local taxes and regulations. Additionally, short-term rentals typically require more frequent cleaning and maintenance, which can add to the overall cost of ownership.

Travel Restrictions and Slow Seasons

Another disadvantage of Airbnb investment properties is their vulnerability to travel restrictions and slow seasons. During periods of low demand, such as the off-season or during a global pandemic, Airbnb hosts may struggle to find guests and generate income. In contrast, traditional rental properties offer more stability, as tenants are locked into a lease for a set period of time.

Conclusion

Ultimately, the decision to invest in either traditional or Airbnb rental properties will depend on an individual’s financial goals, risk tolerance, and personal preferences. Both types of investments offer unique advantages and challenges, and it is essential to carefully weigh the pros and cons before making a decision. By considering factors such as potential ROI, stability, and expenses, investors can make an informed choice that best aligns with their investment strategy.