Real estate has long been considered a solid investment option, offering various benefits such as diversification, income, and professional management. However, it also comes with its fair share of drawbacks, including liquidity issues, interest rate sensitivity, and potential burdens in retirement. In this article, we will explore the pros and cons of investing in real estate, as well as some alternative strategies for those considering entering the market.

Diversification and Income

One of the primary advantages of investing in real estate is the diversification it offers to an investment portfolio. Real estate investments can provide a steady income stream through rental properties, which can be particularly beneficial for retirees seeking additional income. Additionally, professional management services can help investors navigate the complexities of the market and maximize their returns.

Liquidity and Interest Rate Sensitivity

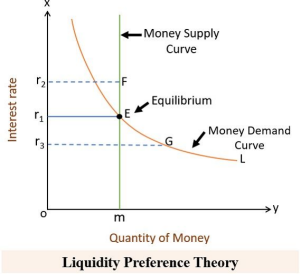

On the downside, real estate investments can be relatively illiquid, making it difficult for investors to quickly convert their assets into cash when needed. This can be particularly problematic for those facing financial emergencies or unexpected expenses. Moreover, real estate investments are sensitive to interest rate fluctuations, which can impact property values and rental income.

Retirement Considerations

Owning a home in retirement can become a burden due to maintenance and repair costs, as well as a lack of accessibility for aging in place. Renting in retirement can offer flexibility, freedom from home maintenance expenses, and built-in communities for socializing. In some circumstances, renting may make more sense than owning, even for retirees who can afford homeownership. Apartments and rental communities for older adults can offer accessibility features and social connections, while continuing care retirement communities (CCRCs) allow for aging in place with access to higher levels of care, albeit with a hefty entrance fee.

Rental Arbitrage

For those seeking alternative real estate investment strategies, rental arbitrage is an option worth considering. This strategy involves leasing a property and subleasing it to short-term renters on platforms like Airbnb. Rental arbitrage has a relatively low initial investment, making it accessible for beginning real estate investors. However, it’s essential to ensure that local governing bodies permit short-term rentals and that the landlord allows subleasing. While rental arbitrage can be lucrative, investors must also consider additional expenses such as utilities, renters’ insurance, cleaning fees, and furniture and decor rentals.

Conclusion

Investing in real estate offers numerous benefits, but it also comes with its share of challenges and potential drawbacks. It’s crucial for investors to carefully weigh the pros and cons and conduct thorough research and due diligence before committing to any real estate investment strategy. By considering factors such as diversification, income potential, liquidity, interest rate sensitivity, and retirement considerations, investors can make informed decisions and maximize their chances of success in the real estate market.