Passive investing has gained significant traction in recent years, with index funds and ETFs becoming increasingly popular investment vehicles. This article explores the growth of passive investing, its impact on the market, and the potential risks associated with this investment approach.

The Rise of Passive Investing

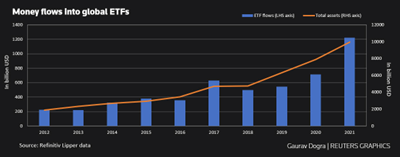

Since the 2008 financial crisis, passive investing has become a dominant force in the American stock market. Major players like BlackRock, Vanguard, and State Street now collectively own roughly 22% of the S&P 500. The rise of index funds can be traced back to the US Internal Revenue Service’s ruling on the tax treatment of 401(k) plans in 1981, which led to a 200-fold increase in the industry’s assets under management from $132 billion in 1980 to $27 trillion in 2021.

ETFs Attracting Inflows Despite Market Volatility

Even in the face of market crashes, such as the one in 2022, ETFs have continued to attract significant inflows. U.S. ETFs saw $597.9 billion in inflows for the year, with fixed-income funds posting the strongest organic growth at $196.4 billion. This resilience demonstrates the appeal of passive investing for many investors, even during challenging market conditions.

Concerns and Criticisms of Passive Investing

Despite its popularity, passive investing has faced criticism from some experts, such as Dr. Michael Burry, who argue that it may be creating a bubble in the public equity markets. The Inelastic Markets Hypothesis suggests that many passive investment vehicles, like mutual funds, index funds, and ETFs, are constrained and lack elasticity, potentially leading to market instability.

Is Passive Investing the Future?

While passive investing has undoubtedly grown in popularity and influence, it remains to be seen whether it will continue to dominate the market in the long term. As investors become more aware of the potential risks associated with this investment approach, they may seek alternative strategies that offer greater flexibility and control. However, the undeniable appeal of passive investing, particularly in terms of its simplicity and cost-effectiveness, is likely to ensure that it remains a significant force in the investment world for the foreseeable future.