Dividend investing has long been a popular strategy for building wealth and generating passive income. In this article, we will explore the benefits of dividend investing and discuss some top dividend stocks that can help you build long-term wealth.

Why Dividend Investing?

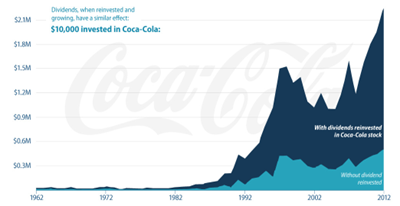

Dividend investing focuses on companies that consistently pay and grow their dividends, providing a steady stream of income for investors. This strategy can be particularly attractive for retirees who rely on passive income for financial security. Dividend-growth stocks can also help investors build a substantial nest egg for retirement.

Top Dividend Stocks for Long-Term Wealth

Some established dividend growers include TC Energy, Allied Properties, and the Canadian Imperial Bank of Commerce. TC Energy owns a vast network of natural gas and crude oil pipelines and has 23 consecutive years of dividend hikes. Allied Properties is a real estate investment trust leading the consolidation of the workspace sector and urban intensification in Canada’s major cities. Canadian Imperial Bank of Commerce has a dividend track record of 155 years and a dividend-growth streak of 12 years. Owning these stocks for an extended period can result in long-term wealth and financial security for retirees.

Dividend Stocks That Can Double Your Money

Using the rule of 72, investors can determine how quickly an investment can double their money. Brookfield Renewable and NextEra Energy Partners are two stocks with mid-teens total return potential over the next several years. Brookfield Renewable has delivered a 17% annualized total return over the last five years and has several drivers that should grow its funds from operations (FFO) at a more than 10% compound annual rate through at least 2027. NextEra Energy Partners has produced a 12.9% average annual total return over the last five years and expects to grow its distribution per share at a 12% to 15% annual rate through at least 2026.

Other Notable Dividend Stocks

Enterprise Products Partners (EPD) is another attractive dividend stock, benefiting from its strong balance sheet, diversified business model, and long-term contracts with customers. EPD operates in the midstream energy sector, which involves transporting, storing, and processing oil and gas. This sector is less cyclical than the upstream exploration and production sector, making EPD’s cash flows more stable.

Conclusion

Overall, dividend investing can be a powerful way to build long-term wealth through stocks. However, it is important to carefully evaluate each stock’s dividend yield, sustainability, and growth potential before investing. The stocks mentioned above are examples of companies that have a strong track record of paying and increasing their dividends, making them attractive options for passive income investors.