Dividend investing is a popular and proven strategy for building long-term wealth. By investing in ASX shares that pay regular dividends, investors can generate a steady stream of passive income and potential capital appreciation. This approach offers stability and reliability, making it an attractive option for self-directed portfolios.

Capitalizing on Compounding and Stability

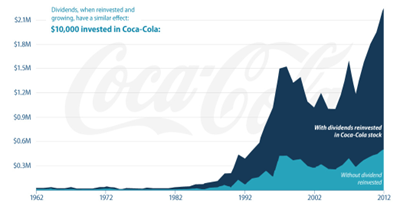

Taking advantage of the power of compounding by reinvesting dividends can lead to exponential growth in a portfolio and income stream. Dividend-paying ASX shares are generally more stable than their non-dividend-paying counterparts, offering some level of protection during market turbulence. This stability is particularly appealing during times of volatility in stock markets, as investors look for safe and defensive bets.

Top Dividend-Paying Stocks

Five ASX shares that analysts recommend for dividends are Aurizon Holdings Ltd, Coles Group Ltd, Rural Funds Group, Telstra Group Ltd, and Westpac Banking Corp. These stocks are major sources of consistent income for investors to create wealth when returns from the equity market are at risk. Stocks with a strong history of year-over-year dividend growth form a healthy portfolio with a greater scope of capital appreciation.

Mature Companies as a Hedge

Mature companies with strong dividend growth histories act as a hedge against economic or political uncertainty as well as stock market volatility. Picking dividend growth stocks appears to be a winning strategy when combined with other parameters such as historical sales and earnings growth, future earnings growth rate, and undervaluation. Insperity Inc., Microchip Technology Incorporated, Darden Restaurants Inc., Dr. Reddys Laboratories, and W.W. Grainger Inc. are five dividend growth stocks that could be compelling picks amid market volatility.

Canadian Dividend Aristocrats

The Canadian stock market has several high-quality stocks with long histories of paying shareholders their dividends and growing payouts each year. Fortis and Canadian National Railway are two Canadian Dividend Aristocrats that can earn investors passive income for decades. Fortis is a utilities holding company that generates most of its revenue through long-term contracted assets in highly rate-regulated markets and has increased its payouts for the last 49 years. Canadian National Railway owns one of the largest railway networks in North America and has paid dividends to its shareholders since 1997 and increased its payouts annually for the last 20 years.