Digital transformation has become a driving force reshaping career trajectories and creating a new paradigm for professionals. The advent of financial technology (fintech), blockchain, and artificial intelligence (AI) has not only introduced innovative products and services but has also led to the emergence of novel job roles, simultaneously challenging and enhancing traditional financial careers. This article delves into the multifaceted impact of these technological advancements on the financial sector’s workforce, highlighting the transformative shift towards a more dynamic and technology-driven future.

Fintech: Bridging Finance and Technology

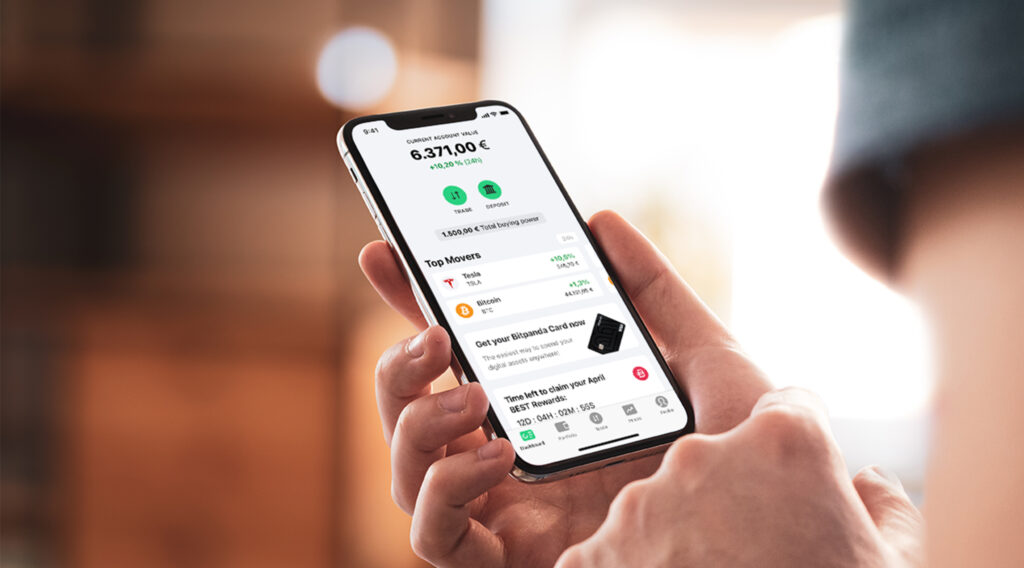

Fintech, a blend of finance and technology, is at the forefront of the digital revolution in the financial industry. It has democratized access to financial services, making them more accessible and efficient for consumers and businesses alike. This democratization has catalyzed the creation of new job roles, such as app developers, cybersecurity analysts, and data scientists, whose skills are essential for developing, securing, and analyzing the plethora of financial services and applications offered by fintech startups and established financial institutions venturing into digital services.

Moreover, fintech has introduced a shift in skill requirements, emphasizing the need for financial professionals to possess a strong understanding of digital tools and platforms. As traditional roles evolve, professionals are increasingly required to blend financial acumen with technological prowess, signifying a move away from purely transactional tasks towards more strategic, tech-driven functions.

Blockchain: A New Frontier for Financial Careers

Blockchain technology, best known for underpinning cryptocurrencies like Bitcoin, has far-reaching implications beyond digital currencies. Its potential for creating transparent, secure, and decentralized ledgers has piqued the interest of financial institutions seeking to streamline operations and reduce fraud. This interest has spurred the demand for blockchain specialists, including developers who can create blockchain-based solutions, legal experts versed in the regulatory implications of cryptocurrencies and smart contracts, and consultants who can guide firms through blockchain integration.

The blockchain revolution is not just creating jobs but is also redefining the essence of trust in financial transactions, necessitating a workforce that understands the intricacies of decentralized finance (DeFi) and can navigate the challenges and opportunities it presents.

Artificial Intelligence: Transforming Financial Services and Employment

AI’s role in transforming financial careers is twofold: it automates routine tasks and generates insights through data analysis, thus altering job roles and creating new opportunities. Automation has streamlined operations, from customer service bots handling inquiries to algorithms executing trades, reducing the need for human intervention in repetitive tasks. While this might imply a reduction in traditional roles, it also opens avenues for professionals to focus on higher-value activities, such as strategic planning and relationship management.

Concurrently, AI’s capability to analyze vast datasets is revolutionizing areas like risk assessment, fraud detection, and personalized financial planning, leading to an increased demand for data analysts, machine learning engineers, and AI ethicists. These roles center on developing, implementing, and overseeing AI technologies, ensuring they align with ethical standards and regulatory requirements.

The Way Forward: Adaptation and Lifelong Learning

The digital transformation of the financial sector demands a workforce that is adaptable, tech-savvy, and committed to lifelong learning. For existing professionals, this means embracing continuous education to remain relevant in their careers, whether through formal qualifications in fintech, blockchain, or AI, or through hands-on experience and professional development courses.

For newcomers, the landscape is ripe with opportunities to enter the financial sector through non-traditional pathways, armed with skills in programming, data analysis, and digital ethics. Educational institutions and companies alike are increasingly offering courses and certifications tailored to these emerging fields, underscoring the importance of interdisciplinary knowledge in navigating the future of finance.

The impact of digital transformation on financial careers is profound and multifaceted, heralding a shift towards more dynamic, technology-driven roles. As fintech, blockchain, and AI continue to evolve, they will undoubtedly create new challenges and opportunities for financial professionals. Embracing change, acquiring new skills, and fostering a culture of innovation are key for individuals and organizations aiming to thrive in this new era. The future of financial careers, while uncertain, is undoubtedly exciting, marked by the promise of technological advancement and the endless possibilities it brings.