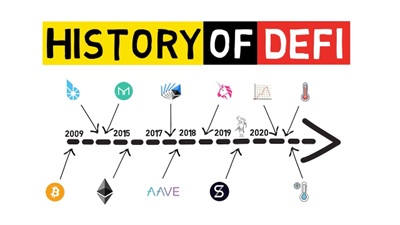

Decentralized finance (DeFi) is revolutionizing the financial landscape by offering a transparent, open, and permissionless alternative to traditional financial systems. Built on blockchain technology, most commonly the Ethereum blockchain, DeFi relies on smart contracts to ensure transparency, immutability, and security in transactions.

Decentralized Applications and Ecosystem

Decentralized Applications and Ecosystem

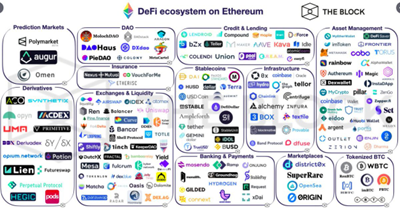

Decentralized applications (DApps) offer various financial services without relying on intermediaries like banks or brokers. DeFi protocols are designed to work seamlessly with each other, allowing users to leverage multiple applications and services within the ecosystem. This interoperability has led to the rapid expansion of DeFi, with billions of dollars locked in DeFi protocols.

Decentralized Exchanges and Liquidity Pools

Decentralized Exchanges and Liquidity Pools

Decentralized exchanges (DEXs) enable peer-to-peer cryptocurrency trading without the need for a central authority. Liquidity pools and automated market makers (AMMs) enable efficient trading, while yield farming and staking incentivize users to participate in the ecosystem. Decentralized autonomous organizations (DAOs) enable token holders to participate in decision-making processes, promoting financial inclusion and innovation.

DeFi Disrupting Traditional Finance

DeFi Disrupting Traditional Finance

DeFi has the potential to disrupt conventional finance in areas such as decentralization, enhanced security, transparency, global accessibility, and financial innovation. It offers solutions to many of the weaknesses of traditional banking, such as reducing the risk of poor decision-making and ensuring asset quality and liquidity. DeFi’s inclusive and democratic nature allows for greater capitalization and reduces the risk of bank runs.

Challenges and Threats in DeFi

Challenges and Threats in DeFi

Despite its potential, DeFi also faces issues and threats, including regulatory challenges and vulnerabilities in smart contracts. Security concerns must be addressed for safe participation in DeFi. As the DeFi ecosystem continues to grow and evolve, it is crucial for users, developers, and regulators to work together to ensure its long-term success and stability.