As the world becomes increasingly digital, the way we handle money has been transformed. The fintech sector is at the forefront of this change, developing alternative payment methods and driving the adoption of digital wallets. This revolution is changing the way we make and receive payments, borrow, save money, and even how banks operate.

Big Banks Join the Digital Wallet Movement

Seven major banks, including Wells Fargo, JPMorgan Chase, and Capital One, are set to launch a new digital wallet later this year. This wallet, initially for online transactions only, aims to drive revenue to the banks and collect consumer information. Managed by Early Warning Services, LLC, the wallet will enable consumers to enter their email addresses linked to their bank account, allowing them to choose which credit or debit card to use for a purchase. With 69% of American consumers using a digital wallet when shopping online, banks are eager to gain revenue and marketing from these transactions.

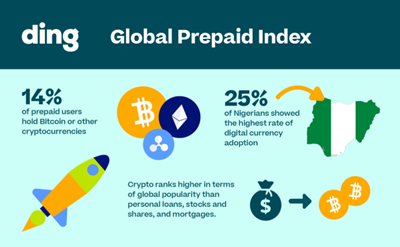

Cryptocurrency Adoption and Blockchain Technology

Mainstream adoption of cryptocurrencies is on the rise, with over 15,000 businesses worldwide accepting Bitcoin. Digital wallets are becoming central to how we pay for goods and store digital assets. Smart ledgers and blockchain technology have the potential to transform the way consumers and businesses handle digital wallets, offering increased security and efficiency.

QR Code Payments: The Future of Contactless Transactions

QR code payments are gaining popularity, with a predicted 240% increase in the US from 2020-2025. These payments are contactless, touchless, and easy to use, making them appealing in a post-pandemic world. QR code payments also offer security and cost benefits for e-commerce companies, streamlining the payment process and reducing the risk of fraud.

Adapting to the Needs of Digital Nomads

As more people embrace remote work and a digital lifestyle, financial services must adapt to cater to the needs of digital nomads. This includes offering solutions not tied to a physical location, digital wallets for easy and secure mobile payments, and blockchain-based solutions for cross-border transactions. Banks may need to provide more flexible and innovative financial solutions to stay competitive in this rapidly evolving landscape.