Exchange-Traded Funds (ETFs) have come a long way since the launch of the first U.S.-based ETF, the Standard & Poor’s Depositary Receipt (SPY), 30 years ago. Today, ETFs offer investors a wide range of opportunities to diversify their portfolios and access various markets. This comprehensive guide will help you understand the risks, rewards, and strategies involved in investing in ETFs.

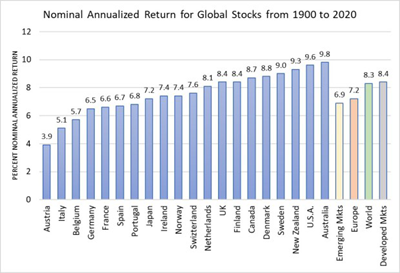

International Stocks: Growth and Variation

Investing in international stocks can provide significant growth opportunities, as evidenced by the stock market returns for nine countries from 1993 to 2022. However, there is considerable variation in returns between the best and worst-performing equity markets, with a difference of around 4% per year. Understanding the ebb and flow of equity performance over time can help you make informed decisions when investing in international stocks through ETFs.

Risks and Measuring Risk in International Stocks

Investing in international stocks comes with its share of risks, such as currency fluctuations and geopolitical factors. One way to measure risk is by looking at the total decline from all-time highs, also known as drawdowns. By considering these risks and incorporating them into your investment strategy, you can better navigate the world of ETFs and make more informed decisions.

ESG Factors and Reporting

Environmental, social, and governance (ESG) factors are increasingly important for investors when choosing stocks and investment funds. ESG reporting and disclosure are becoming more transparent and easier to understand as new reporting standards emerge. However, without a standardized framework for ESG reporting, it can be challenging for investors to compare ESG investments. This is an essential aspect to consider when navigating the world of ETFs.

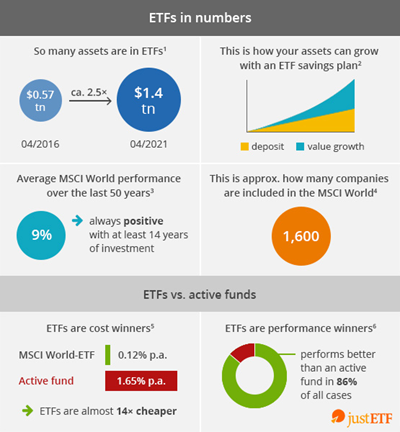

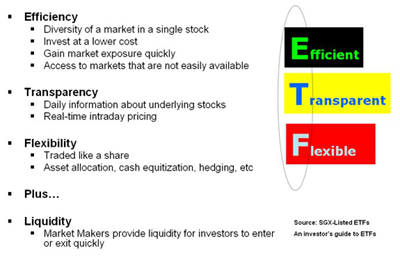

ETF Advantages and Growth

ETFs offer several advantages over mutual funds, including intraday trading, no minimum purchase requirement, lower annual fees, and greater tax efficiency. The growth of ETFs has been aided by the growing awareness of indexing as a superior way of owning the market over stock picking and the explosion of the internet and Dotcom phenomenon. ETFs have expanded beyond equities, into bonds and commodities, and gained even more adherents after the Great Financial Crisis in 2008-2009. As ETFs continue to grow, they may be poised to overtake mutual funds in the investment world.