As the world of cryptocurrency continues to evolve, businesses must adapt to the changing landscape and capitalize on the opportunities it presents. This article explores the various aspects of the cryptocurrency market, including the rise of NFTs, the integration of Web3 and Web2 financial systems, and the importance of diversification and integration for investors.

Non-Fungible Tokens (NFTs) and Their Market Dynamics

Ethereum dominates the NFT market volume, but network congestion and fees may drive users to alternatives such as Polygon. Platforms like Blur and OpenSea cater to high-end and retail traders, but both encroach on each other’s territory and may integrate. Investment in NFT projects has decreased, indicating investors’ caution about investing. However, platform building and scalability solutions are essential for NFTs, as demonstrated by Flow’s $3 million seed funding of its NFT marketplace.

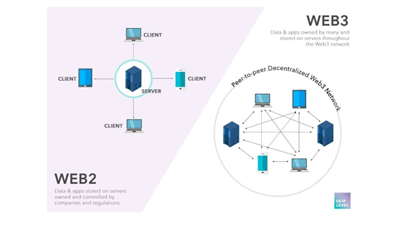

Web3 and Web2 Financial Systems Integration

Integrating Web3 and Web2 financial systems presents both challenges and opportunities. Harnessing the advantages of both systems can create a more inclusive and efficient global financial system. Innovative platforms like Swapin enable the seamless exchange of assets between Web3 and Web2 financial systems. However, technological and infrastructure barriers, as well as complex regulatory environments like the EU’s MiCA regulation, pose significant hurdles in integrating these systems.

Emerging Projects and Investment Opportunities

Projects like DigiToads and Yachtify (YCHT) offer unique investment opportunities in the cryptocurrency market. DigiToads is a Web3 project built on the Ethereum blockchain, while Yachtify disrupts the market of fractional yacht ownership. Both projects have garnered attention from investors and the wider crypto community, presenting unique features and investment opportunities. However, investors should exercise caution in their investment choices and consider more reliable alternatives like Yachtify (YCHT).

Diversification and Integration in the Cryptocurrency Market

Diversification and integration are crucial for investors seeking to navigate the digital asset ecosystem. Diversification is the practice of spreading investments across a range of assets to mitigate risk and maximize returns. Integration describes the seamless integration of a new financial system or instrument into the current financial structure. Including cryptocurrencies in an investment portfolio can provide diversification benefits and risk management, as they have a poor connection with traditional assets such as equities, bonds, and commodities.