Effective cash flow management is crucial for the success of any business. By implementing smart strategies and techniques, you can maximize your cash flow and ensure your business remains financially stable. In this article, we will discuss some key methods to help you achieve financial success.

- Debtor Finance

Debtor finance, also known as invoice financing, allows businesses to leverage their accounts receivables for immediate cash flow. By releasing funds against accounts receivable invoices, businesses can free up cash flow for reinvestment. Benefits of debtor finance include more predictable cash flow and improved debt collection performance. Common financing options include short-term working capital loans, purchase order finance, invoice discounting, and trade finance. It’s essential to find the right debtor finance provider that offers transparency in fees and understands your business’s

operations and needs.

- Expense Management

Effective expense management is crucial for maximizing cash flow. By tracking and reviewing both fixed and variable expenses, you can make more informed decisions about resource allocation. Fixed expenses include rent, insurance, and salaries, while variable expenses change month-to-month, such as inventory, marketing, and utilities.

- Cash Flow Forecasting

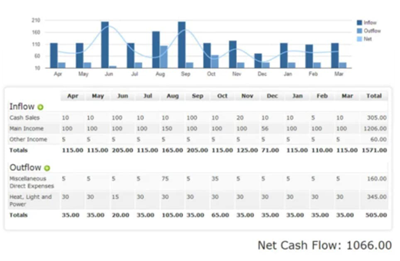

Creating a cash flow forecast helps predict your business’s cash inflows and outflows over a specific period. This allows you to plan for upcoming expenses, anticipate slow periods, and ensure you have enough cash on hand to cover unexpected costs.

- Debt Management

Managing debt effectively is essential for maintaining financial stability. Prioritize paying off high-interest debt, negotiate with lenders, and consider debt consolidation to reduce your overall debt load more quickly.

- Forecasting and Planning

Stay up-to-date on industry trends, use data to inform your decisions, and create contingency plans to prepare for emergencies and minimize the impact of unexpected changes in the market.

- Tax Planning

Keep accurate records, consult a tax professional, and take advantage of deductions and credits to reduce your tax liability and keep more of your hard-earned money.

- Investing

Diversify your portfolio, start small, and consult a financial advisor to help you identify investments that align with your goals and risk tolerance, and provide guidance on managing your portfolio over time.