Passive income is the key to financial freedom, and one of the best ways to achieve this is through investing in dividend stocks and exchange-traded funds (ETFs). In this guide, we will explore how to build wealth through these investment vehicles, using the example of Brookfield Renewable Partners (BEP) – the largest and oldest yield in the world.

A Safe and Growing Yield: Brookfield Renewable Partners (BEP)

BEP is managed by Brookfield Asset Management (BAM) and offers a safe 7.3% yield, which is expected to grow at a rate of 5% to 9% over time. This makes it an attractive investment option for those looking to generate passive income. With an estimated 16.5% compound annual growth rate (CAGR) in total returns over the next decade, BEP is a promising choice for long-term investors.

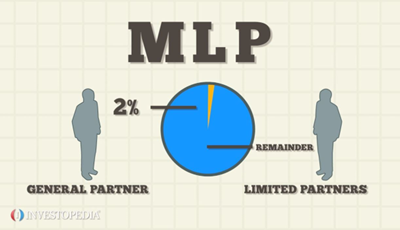

Structure and Ownership: Master Limited Partnership (MLP)

BEP is structured similarly to a master limited partnership (MLP) and is 60% owned by BAM. This structure allows for tax advantages and a steady flow of income, making it an appealing option for investors seeking passive income.

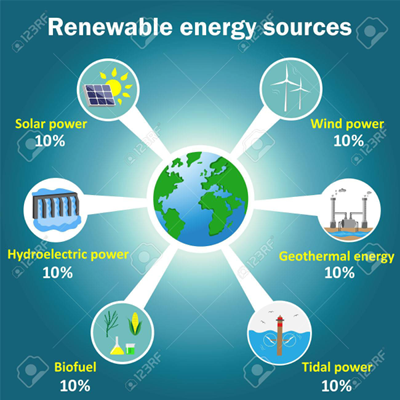

Diversification: From Hydropower to Wind, Solar, and Energy Storage

Initially focused solely on hydropower, BEP has diversified its portfolio to include wind, solar, and energy storage. This diversification reduces risk and ensures a steady stream of income from various renewable energy sources. As the world’s largest publicly traded provider of renewable power, BEP boasts 877 assets in 15 countries, further solidifying its position as a reliable investment option.

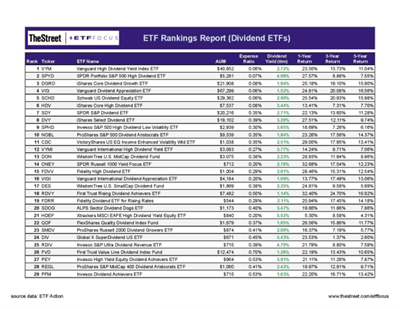

Investing in Dividend Stocks and ETFs: A Path to Financial Freedom

Investing in dividend stocks and ETFs, such as BEP, can be a powerful strategy for building wealth and generating passive income. By carefully selecting high-yield, diversified, and well-managed investments, you can create a steady stream of income that will help you achieve financial freedom. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.