Financial planning and wealth management are essential aspects of securing a stable and prosperous future. By understanding common investor behaviors and implementing effective solutions, individuals can make informed decisions that lead to long-term financial success.

Behavior 1: Selling during market downturns

Behavior 1: Selling during market downturns

One common mistake investors make is selling during market downturns, driven by fear and a desire to minimize losses. To combat this urge, consider investing in a fund or structure that is time-consuming to exit, such as a private equity fund or a property investment trust. This strategy can help prevent impulsive decisions and encourage a long-term investment mindset.

Behavior 2: Failing to maintain asset allocation discipline

Behavior 2: Failing to maintain asset allocation discipline

Another common issue is the failure to maintain asset allocation discipline. Investors who struggle with this can use a robo-advisor or target-date fund to automate the process. These tools adjust the portfolio’s asset allocation based on the investor’s age, risk tolerance, and investment goals, ensuring a balanced and diversified portfolio.

Behavior 3: Reacting to short-term market volatility

Short-term market volatility can lead to impulsive decisions and a focus on immediate gains or losses. To overcome this behavior, investors should focus on their long-term goals and ignore short-term market movements. This approach requires discipline and a willingness to ride out market downturns, ultimately leading to more consistent returns over time.

Behavior 4: Selling during market downturns

Creating an emergency fund is an effective solution for investors who tend to sell during market downturns. This fund should be separate from the investment portfolio and easily accessible, providing a financial safety net for unexpected expenses. By having an emergency fund in place, investors can avoid making impulsive decisions based on short-term market fluctuations.

Behavior 5: Exiting markets when portfolio declines

Behavior 5: Exiting markets when portfolio declines

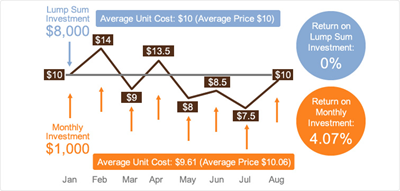

Investors who exit markets when their portfolio declines can benefit from using dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, smoothing out market volatility, and reducing the impact of short-term market movements. By consistently investing over time, investors can build wealth and achieve their long-term financial goals.