As the world shifts towards a greener economy, investing in renewable energy has become a key focus for corporations and investors alike. Corporate Knights, a leading authority on sustainability, has been tracking the world’s largest companies and their commitment to sustainability for over two decades. In recent years, the best investments have been those companies that have embraced the green economy wholeheartedly.

Top Performers in Sustainable Investment

Corporate Knights’ Sustainable Economy Intelligence (SEI) Database ranks over 2,800 public companies primarily by the percentage of revenues and spending derived from the green economy. In the most recent three-year period, the top 20% of SEI companies outperformed the MSCI All-World Index by a factor of three to one. The value of the top quintile of the SEI grew 146% between January 1, 2019, and March 22, 2023, compared to 47% for the MSCI ASCWI.

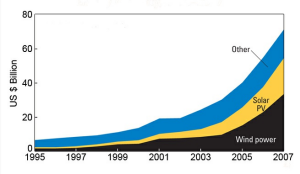

Global Investment in Energy Transition

Global investment in the energy transition surpassed US$1 trillion for the first time in 2022. To achieve net-zero carbon emissions by 2050, the global annual investment must more than triple for the rest of the decade. Infrastructure is perceived as a stable asset class with tangible and essential underlying assets, making it a crucial component in the fight against climate change. Renewable energy infrastructure offers a significant investment opportunity to work towards sustainability goals.

Private Sector Investment in Renewable Energy

The International Renewable Energy Agency (IRENA) estimates that over 80% of the required $110 trillion investment in the energy system by 2050 needs to be invested in renewables, energy efficiency, end-use electrification, and power grids and flexibility. Private sector investment is critical to delivering the required level of investment in renewable energy. Investing in renewable energy offers two opportunities: involvement in the development and construction of renewable energy and purchasing already constructed assets to hold over longer periods.

Oil and Gas Companies at a Crossroads

Multinational oil and gas companies are at a crossroads as the world transitions toward a more sustainable economy. BP has made significant investments in renewable energy, while Exxon has remained more cautious, focusing on its core business. BP nearly doubled its Electric Vehicle charging points to 22,000 in 2021, compared to a 14% commitment by XOM. BP plans to spend about half of its Capex on renewables by 2030. Investing in the fossil fuel industry represents a calculated bet on the continued demand for oil and gas, at least for enough time to make a decent profit. XOM is a more compelling choice than BP primarily due to its focus on its core business and its superior financial performance. Both companies face geopolitical risks, as evidenced by Chad’s recent nationalization of XOM assets.