ESG investing is a rapidly growing trend that takes environmental, social, and governance factors into account when making investment decisions. By the end of 2022, investor assets in sustainable investments amounted to $8.4 trillion, making up about 12.6% of all U.S. assets under management. This growth has attracted the attention of politicians and regulators, leading to the SEC proposing stricter rules surrounding sustainability fund names.

Understanding the Different Types of Sustainable Funds

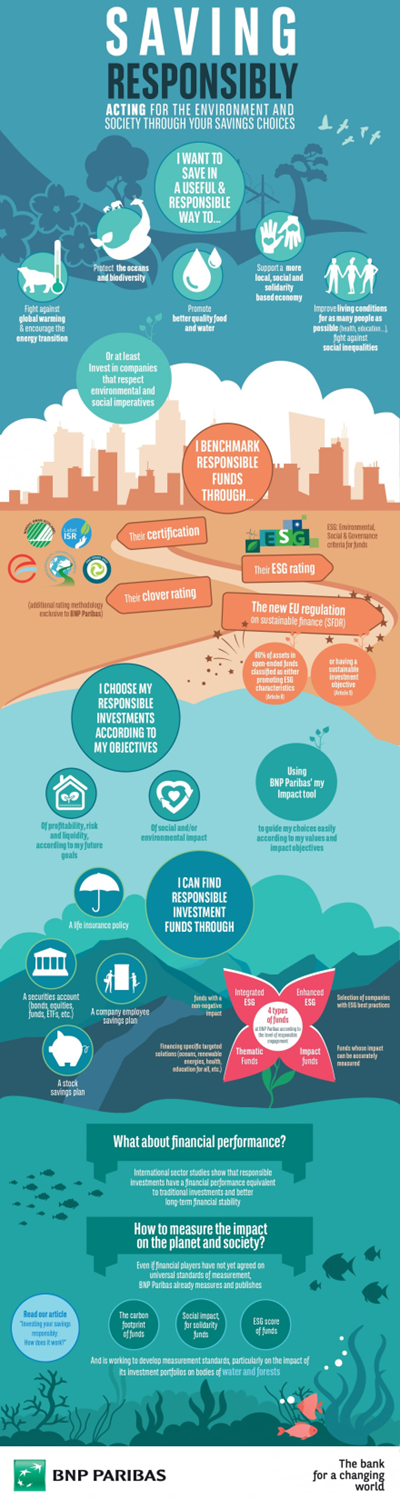

Sustainable funds generally fall into three major categories: socially responsible funds, ESG funds, and impact funds. Socially responsible funds exclude investing in firms with significant revenues from controversial industries, while ESG funds invest in companies that score highly on environmental, social, and governance criteria. Impact funds, on the other hand, seek to create tangible progress toward sustainable goals.

Aligning Your Investments with Personal Values

Both ethical investing and ESG investing involve allocating investment dollars according to personal beliefs. However, ethical investing is subjective and based on personal values, while ESG investing is objective and uses data. To align your investments with your values, start by identifying your passions and investment priorities, setting clear goals, and prioritizing your values. Be aware of greenwashing and use ESG scores to evaluate compliance and performance, while conducting personal research to ensure companies aren’t greenwashing.

ESG Savings Options and Personalized Indexing

ESG savings options include 401(k)s and IRAs, which can be tailored to align with employees’ investment values. ESG ETFs are baskets of stocks and bonds that can be bought and sold at any time, providing a flexible investment option. Personalized indexing allows investors to create a custom portfolio that reflects their unique values and

priorities.

ESG Reporting and Disclosure: Navigating the ESG World

As ESG investing gains popularity, reporting and disclosure are becoming more transparent and easier to understand. Although there are no universal global mandatory standards for ESG reporting and disclosure yet, voluntary reporting is increasing. Environmental factors include GHG emissions, climate risk, energy usage, water usage, waste management, pollution, recycling, biodiversity loss/preservation, and deforestation. Social factors cover fair pay, human rights, diversity and inclusion, workplace health and safety, labor standards, employee benefits, data protection, and privacy, community relations/impact, customer satisfaction, and consumer protections. Governance factors encompass board structure, stakeholder engagement, shareholder rights, risk management, compliance, business ethics and transparency, executive compensation, internal controls, conflicts of interest, bribery and corruption, and political contributions.