As the financial services sector continues to evolve, the integration of biometrics is playing a crucial role in enhancing security and user experience. Companies are increasingly adopting advanced authentication methods to prevent financial crimes and fulfill regulatory requirements, while also improving customer experience.

Biometric Partnerships and Market Growth

Recent partnerships, such as Salesforce integrating Onfido’s digital identity verification into its Financial Services Cloud and Shufti Pro providing identity verification to NFT marketplace Moment, demonstrate the growing demand for biometric solutions. The Global Advanced Authentication in Financial Services Market is expected to reach $11.3 billion by 2028, driven by increased non-cash payments and the need for secure transactions.

Advanced Authentication Techniques

Advanced authentication techniques, such as hardware tokens, software tokens, and biometric systems, are conceptually distinguished from traditional authentication techniques like passwords, which are often targeted by scammers. The adoption of advanced authentication methods helps financial services companies proactively prevent fraud rather than relying on reactive protocols.

Digital Banking and Biometrics

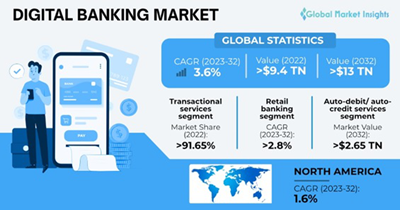

The global digital banking market is expected to have a CAGR of 13-14% from 2023 to 2030, reaching an estimated market size of USD 22.3 billion. The growing popularity of digital banking services, driven by convenience, speed, and flexibility, has led to an increased demand for biometric solutions. Key players in the digital banking market, such as JPMorgan Chase, Bank of America, and Wells Fargo, are focusing on improving customer experience and adopting new technologies like biometrics and blockchain.

Voice Biometrics in Financial Services

The market for speech biometrics is expanding due to the need for simple and reliable authentication methods. Voice biometrics technology uses a person’s distinctive voiceprint to confirm their identification, making it an excellent option for banking, financial services, and healthcare sectors. The rising use of mobile devices and the integration of artificial intelligence (AI) and machine learning (ML) are expected to drive significant growth in the voice biometrics industry over the next several years.