Municipal bonds are an attractive investment option for many investors, offering tax advantages and the opportunity to support public projects. This guide will provide a comprehensive overview of municipal bonds and how to invest in them, including the importance of diversification, credit ratings, interest rates, and maturity dates.

Understanding Municipal Bonds

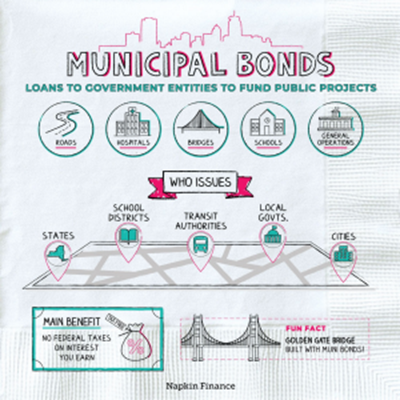

Municipal bonds are debt securities issued by state and local governments to fund public projects such as infrastructure, schools, and hospitals. These bonds offer tax advantages for investors, as the interest income is generally exempt from federal taxes and, in some cases, state and local taxes for residents of the issuing state. However, it is essential to be aware of the risks associated with investing in municipal bonds, including credit risk and interest rate risk.

Purchasing Municipal Bonds

Investors can purchase municipal bonds through a broker or directly from the issuer. When investing in municipal bonds, it is crucial to consider factors such as credit ratings, interest rates, and maturity dates. Credit ratings indicate the creditworthiness of the bond issuer and can help investors assess the risk of default. Interest rates affect the bond’s yield, with higher interest rates generally leading to higher yields. Maturity dates determine when the bond will be repaid, with longer maturity dates typically offering higher yields but also carrying greater risks.

Diversification and Risk Management

Diversification is essential when investing in municipal bonds, as it helps to spread risk across different issuers and sectors. By investing in a variety of bonds with different credit ratings, interest rates, and maturity dates, investors can reduce the impact of any single bond defaulting or experiencing significant price fluctuations. Additionally, investors should be aware of the unique risks associated with specific asset classes, such as small-cap company stocks, which may involve greater risks than those associated with larger companies.

Real-World Examples and Expert Guidance

Several experts and real-world examples can provide valuable insights into investing in municipal bonds. For instance, Vanguard retirement specialist Maria Bruno discusses key ways that pre-retirees can gauge the viability of their plans, while retirement expert Wade Pfau shares his concerns about retiree spending rates and sequence risk during retirement. Morningstar contributor Mark Miller reviews ways to maximize Social Security benefits and how to avoid the “tax torpedo.”

Additional Considerations for Municipal Bond Investors

Investors should also be aware of the potential impact of high inflation on retirees and the best inflation-fighting investments for retirement portfolios. Medical care in retirement is another crucial consideration, with key Medicare changes for 2023 being a topic of discussion. Finally, the Financial Data Transparency Act (FDTA) and the SEC’s adoption of structured data as a RegTech tool highlight the importance of modernizing how data is collected and analyzed in the financial industry.