Financial literacy is crucial for young people to understand how to manage their money and avoid financial pitfalls. With the average Pennsylvania household carrying a credit card balance of more than $5,000 at high-interest rates, it’s clear that there is a need for better financial education. Only 15% of high schoolers in Pennsylvania are guaranteed to take a full semester of personal finance class, but Senate Bill 647 aims to strengthen personal finance education in the state.

Philadelphia Financial Scholars and Personal Finance Education

Philadelphia Financial Scholars is a nonprofit organization that provides high school students, teachers, and families with the tools needed to develop financial capability and build wealth. Students learn how to budget, read financial agreements, understand different types of loans, and the meaning of APR. Learning how to manage finances should be a fundamental part of a student’s learning, as personal finance education is crucial for high school students to give them a jumpstart in life and feel confident about their financial future.

South Carolina Financial Literacy Master Teacher Program

South Carolina Financial Literacy Master Teacher Program

State Treasurer Curtis Loftis recognized 15 educators from across South Carolina for completing the South Carolina Financial Literacy Master Teacher Program. The program is designed to increase the number of teachers incorporating personal finance education into their classrooms and provides financial incentives, specialized training, and financial literacy curriculum resources to K-12 teachers at no cost to schools. The South Carolina Financial Literacy Master Teacher Program encourages educators to teach personal finance education in their classrooms and helps them hold professional development workshops for their fellow educators.

Florida Atlantic University College of Business Executive Education Program

The Florida Atlantic University College of Business Executive Education program ranked No. 2 in the United States in the 2023 Financial Times rankings for open-enrollment professional education programs. FAU was the only university in Florida and one of only seven in the U.S. to be honored. FAU also ranked No. 1 in the U.S. and No. 4 in the world for female participation and No. 17 globally for overall satisfaction. Financial Times establishes the rankings using student feedback, course design, faculty, teaching methods, and facilities.

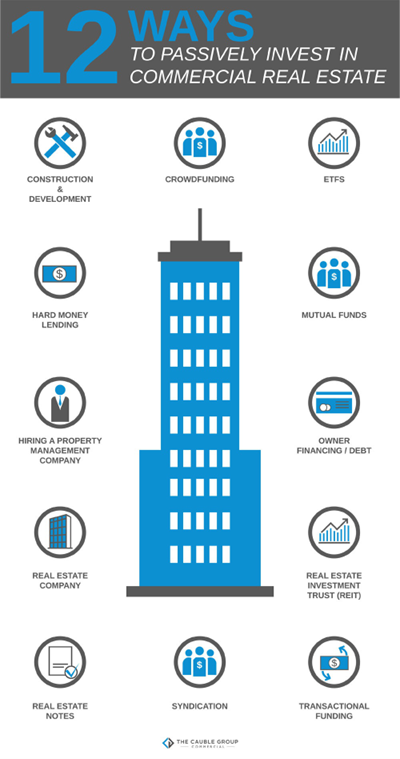

Passive Real Estate Investing for High-Income Professionals

Financial literacy for physicians and high-income professionals in passive real estate investing is essential, especially in the current uncertain market, termed the “Winter Season.” Knowledge is crucial for thriving in the face of adversity. Understanding active vs. passive real estate investing is vital, as active investing involves being your own landlord, while passive investing involves investing in someone else’s deal. Passive investing appeals to those seeking time freedom and additional income streams. It’s essential to consider financial goals and risk tolerance when deciding between active and passive investing.