With the increasing global focus on sustainability and climate change, green bonds have emerged as a promising investment opportunity. These bonds are designed to finance projects that have a positive impact on the environment and contribute to the transition toward a low-carbon economy. This article delves into the world of green bonds and highlights recent developments in sustainable finance.

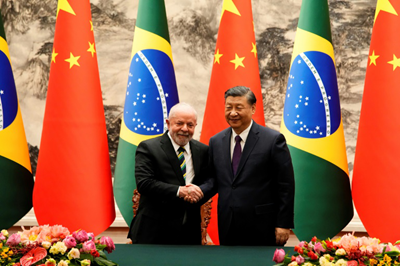

China and Brazil: A Partnership for Sustainable Agriculture and Green Finance

Recently, China and Brazil held a dialogue on sustainable agriculture business and green finance, aiming to promote knowledge exchange and cooperation for a sustainable future in the agribusiness sector. With trade in agricultural products between the two countries reaching US$53 billion in 2022, the potential for green finance to support sustainable agriculture is immense. The Climate Bonds Initiative will play a crucial role in promoting dialogue and developing common standards for green agriculture in both countries.

Unlocking Capital for a Net Zero Future: The Role of Policymakers

The Climate Bonds Initiative has released a new policy report titled “101 Sustainable Finance Policies for 1.5°C,” which outlines how policymakers can facilitate the transition of global economies into a net zero future. By implementing policies such as green guarantees, blended finance facilities, and preferential green trade windows, policymakers can de-risk green investment opportunities and enable private investment to flow towards sustainable projects.

Investing in a Low-Carbon World: Sustainable Funds and Green Bonds

In light of Earth Day 2023, this article discusses the potential for sustainable investing through over 600 sustainable mutual funds and ETFs available for investors. These funds aim to provide competitive returns while also having a positive impact on people and the planet. Additionally, corporate and municipal bonds tied to sustainable goals are becoming more popular, offering investors a wide range of opportunities to support a lower-carbon future.

Green Finance in India: A Key Component of the Transition to a Net-Zero Economy

Green finance is gaining momentum in the Indian economy, with banks offering green loans and investors buying debt securities such as green bonds to finance environmentally friendly projects. The market for Green Social, Sustainability, and Sustainability-linked (GSSS) bonds is gradually expanding in India, accounting for US$20 billion as of January 2023. As reporting norms and guidelines continue to evolve, the market for green bonds in India is expected to grow further.