The digital revolution has transformed the way we make and receive payments, with fintech innovations and the rise of cryptocurrencies gaining mainstream adoption. This shift in payment methods is significantly impacting the online retail landscape, offering increased security, convenience, and new opportunities for growth.

The emergence of Digital Wallets and E-payments

As electronic payments increasingly displace cash, digital wallets have become central to the way we pay for goods and transfer funds. In Africa, for example, the e-payments market is expected to see revenues grow by approximately 20 percent per year, reaching around $40 billion by 2025. The COVID-19 pandemic has further accelerated this shift, with contactless payments and e-commerce experiencing rapid growth worldwide.

Cryptocurrencies and Blockchain Technology

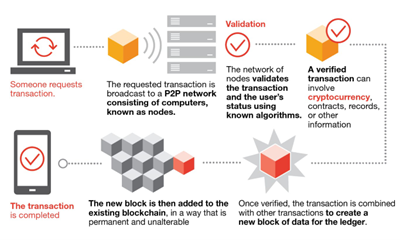

Merchants who accept digital currencies are seeing a positive impact on customer metrics, while smart ledgers and blockchain technology promise to revolutionize the way we handle digital wallets. As cryptocurrencies become more widely adopted, they offer new opportunities for online retailers to tap into new markets and customer segments.

QR Code Payments and One-Click Transactions

QR code payments are on the rise, predicted to increase by 240% in the US from 2020-2025. These payments offer security and cost benefits for e-commerce companies, while one-click payments provide convenience for customers. However, as security concerns grow, two-click payments may become the new norm to balance convenience and safety.

Central Bank Digital Currencies and Collaboration

Central bank digital currencies (CBDCs) could promote financial inclusion and reduce the risks associated with digital payments and cryptocurrencies. To ensure the successful implementation of CBDCs, collaboration between governments, financial institutions, and technology companies is essential. This cooperation will help create a secure, efficient, and inclusive digital payment ecosystem that benefits both online retailers and consumers.