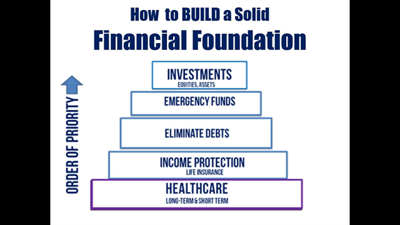

With the current market uncertainty and the need for education and preparation, it’s more important than ever to build a robust financial foundation. This article discusses strategies for long-term success, focusing on passive real estate investing for physicians and high-income professionals.

The Winter Season of Financial Instability

As we navigate the current season of financial instability, it’s crucial for physicians and high-income professionals to position themselves to take advantage of forthcoming opportunities. This article aims to equip them with the fundamental knowledge needed to begin their journey of passive real estate investing.

Understanding Active vs. Passive Real Estate Investing

Active investing involves being your own landlord, managing, buying, selling, and overseeing every aspect of your property. On the other hand, passive investing involves investing in someone else’s deal, such as a syndication or fund. Passive investing appeals to those who seek time freedom and additional income streams beyond their day jobs.

Deciding Between Active and Passive Investing

When deciding between active and passive investing, it’s crucial to consider your financial goals, risk tolerance, and personal involvement. By understanding the differences between these two investment strategies, you can make informed decisions that align with your long-term financial objectives.

Building a Strong Foundation for Future Growth

Building a Strong Foundation for Future Growth

Companies like LightInTheBox Holding Co., Ltd. have demonstrated the importance of building a strong financial foundation to unlock additional growth opportunities and future prospects. By focusing on affordable, value-oriented offerings and innovative technologies, organizations can lay the groundwork for long-term success in their respective industries.