Exchange-Traded Funds (ETFs) have become increasingly popular among investors due to their diversification, low costs, and ease of trading. This guide will provide an overview of various types of ETFs and how they can be incorporated into your investment strategy.

Investing in Socially Responsible ETFs

Investing in Socially Responsible ETFs

The iShares ESG Aware MSCI EAFE ETF is an example of a socially responsible ETF that focuses on environmentally and socially responsible companies outside of North America. With a market capitalization of $7.41 billion and a P/E ratio of 12.51, this ETF has attracted the attention of institutional investors and hedge funds, such as Jane Street Group LLC and Flow Traders U.S. LLC.

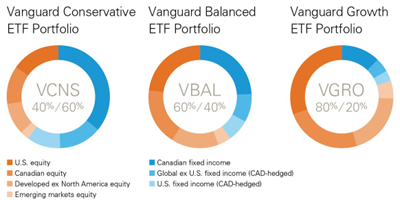

Asset Allocation ETFs for Building Wealth

Asset allocation ETFs bundle multiple stock and bond ETFs into single portfolios, making them an excellent choice for building wealth in various types of accounts. The 2023 Globe and Mail ETF Buyer’s Guide provides a comprehensive comparison of fees, returns, top holdings, and the mix of stocks, bonds, and cryptocurrency of various asset allocation ETFs, focusing on balanced and growth funds.

Investing in Undervalued Sectors and International Stocks

The Communication Services Select Sector SPDR Fund (XLC) is an ETF that provides exposure to the undervalued communication services industry, holding a diversified portfolio of companies, including Facebook and Google. For those looking to invest in undervalued international stocks, the iShares MSCI EAFE Value ETF (EFV) offers a diversified portfolio of companies in developed markets outside of the U.S., focusing on value stocks.

Fixed-Income Opportunities with Leveraged Loans

Leveraged loans offer strong yields in the fixed-income space, making them an attractive investment opportunity. The Invesco Senior Loan ETF (BKLN) provides exposure to leveraged loans, holding a diversified portfolio of loans to non-investment grade companies and focusing on floating rate securities.

Conclusion

Investing in ETFs can be a smart way to diversify your portfolio and gain exposure to various sectors, regions, and asset classes. As with any investment, it is essential to carefully consider your financial situation, risk appetite, and other factors before making any investment decisions. With the wide variety of ETFs available, there is likely an option that aligns with your investment goals and strategy.