Green bonds are a rapidly growing investment vehicle that allows investors to combine financial returns with positive environmental impacts. As the world becomes more aware of the need for sustainable practices, green bonds are gaining popularity among both individual and institutional investors.

The Rise of ESG Investing

Environmental, social, and governance (ESG) investing has become a popular trend in recent years. ESG funds are portfolios of securities and bonds from companies that have included environmental, social, and governmental factors in their investment process. This type of investing allows investors to support companies that promote positive environmental, social, and governance fundamentals, while also generating financial returns.

Green Bonds: A Growing Market

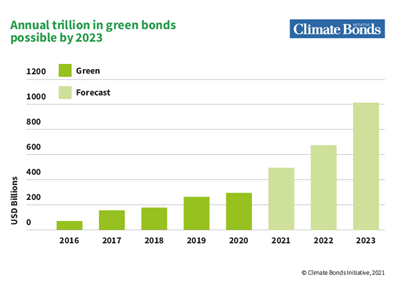

Green bonds are a specific type of ESG investment that focuses on financing environmentally friendly projects, such as renewable energy, clean transportation, and sustainable agriculture. The market for green bonds has grown significantly in recent years, with both public and private issuers offering these investment opportunities. This growth is driven by increasing demand from investors who want to align their financial goals with their environmental values.

Benefits of Investing in Green Bonds

Investing in green bonds offers several benefits for investors. First, green bonds provide a way to diversify investment portfolios by adding exposure to environmentally focused projects. This can help reduce risk and improve overall portfolio performance. Second, green bonds often have a positive environmental impact, allowing investors to support projects that contribute to a more sustainable future. Finally, green bonds can offer competitive financial returns, making them an attractive option for investors seeking both financial and environmental benefits.

Overcoming Challenges and Controversies

While green bonds offer many benefits, they are not without challenges and controversies. Some critics argue that ESG investing, including green bonds, can be seen as a money grab, with companies taking advantage of the trend to attract investment. Additionally, there is a need for greater transparency and standardization in the green bond market to ensure that investments are truly supporting environmentally friendly projects. Despite these challenges, the potential for green bonds to combine financial returns with positive environmental impacts makes them an increasingly attractive option for investors seeking to align their financial goals with their values.